Deciding on Your Investment Mix

Deciding where you put your money and in what amounts is important to achieving your financial independence. Earlier you read about discovering your risk tolerance. Now, you can use that knowledge to piece together a financial independence plan that is comfortable to you.

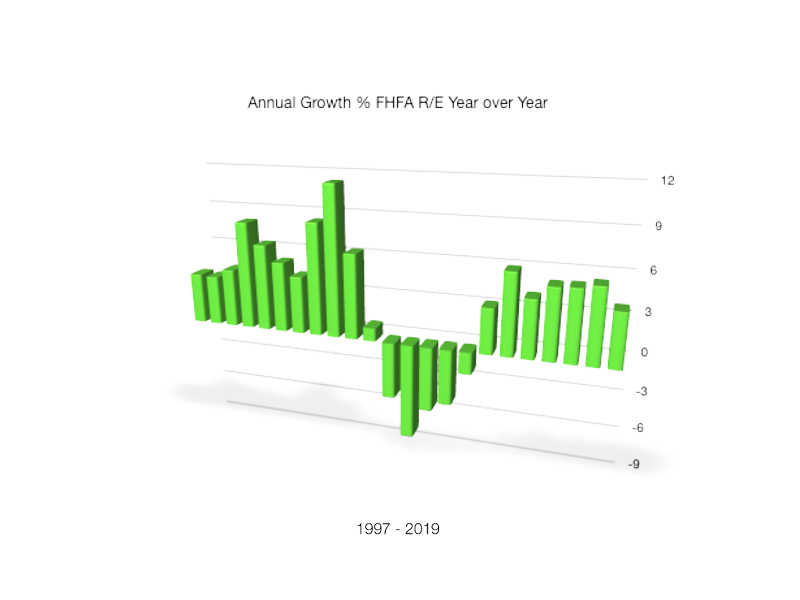

Lots of opinions abound describing how best to allocate your money amongst the options. When you read material from "Wall Streeters" you will notice that they would have you put all your money into investments in which they are interested. Generally, in their eyes your home, rental properties, property flips, etc, do not count as an investment. They certainly do!. Real estate is important to your financial independence.

Lots of people have become financially independent using real estate as an investment vehicle. It is an important element to consider in your investment portfolio.

So, take care when you read the "marketing" materials from brokerage firms.

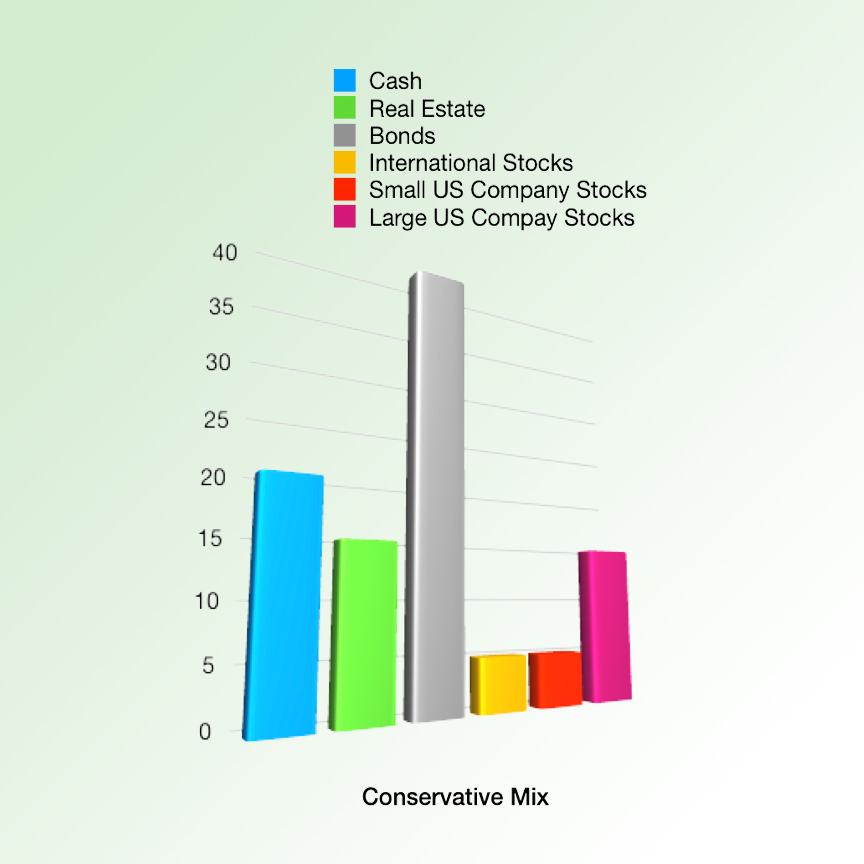

Characterized by an investment period of less than ten years before you begin using the plan to generate income. This profile is primarily for individuals desiring to generate income and preserve their capital. Generally, if you decide to base your plan on this category, your principle concern is not increasing your wealth.

Characterized by an investment period of between ten and fifteen years before you begin using the plan to generate income. This structure is for individuals desiring reasonable growth of personal wealth. The structure prefers stability over risk. If you center your plan on this category, you aren't concerned with generating income. But, you are bothered by frequent volatility and seek consistent performance in adding to your wealth.

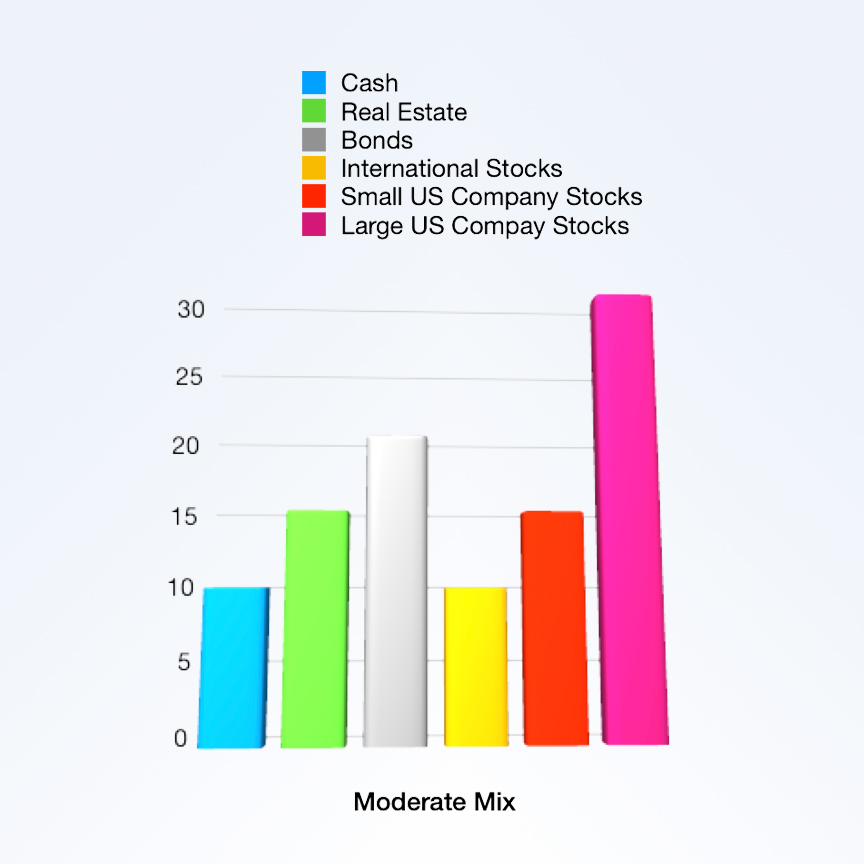

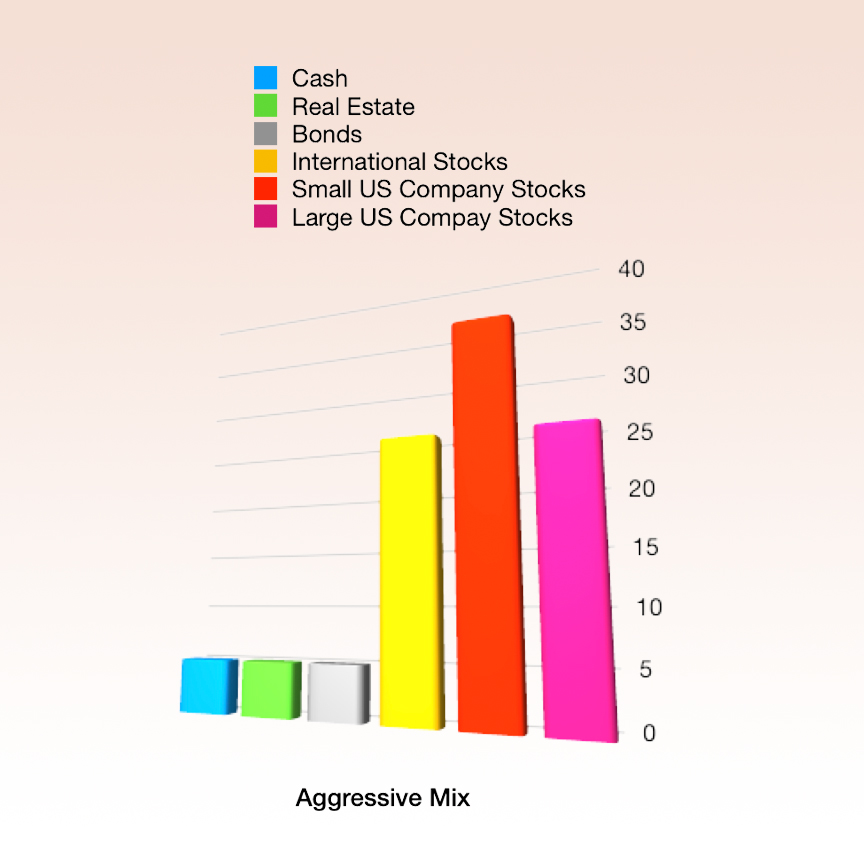

Characterized by an investment period of more than fifteen years before you begin using the plan to generate income. This profile is for individuals desiring aggressive growth of personal wealth. This grouping persues high growth and accepts higher levels of risk. When you decide to use this category, you concentrate on generating rapid growth of your wealth. But, you are willing to endure frequent volatility.

THE MIX IS YOUR CHOICE

Needless to say the return from any one piece of real estate will bring a different reward than any other such investment. It may be that you are averse to being a landlord or a rehab specialist or land developer and therefore rule out investing in real estate (except your own home of course).

Again, the final mix in your portfolio is your choice!